- Trading technologies

- Trading integration software and analytics

- Financial media (market commentary, analysis, news and market data)

Since then the property business has grown rapidly, resulting in widening our focus to apply our technology skills to creating solutions for the property and wellbeing markets.

This property success has redirected our focus towards the technology business we now see as core.

Our highly experienced team understands the opportunities and issues facing the financial technology market, property agency market, property management systems, property indices for rental valuations, segmentations and valuations.

The management team has the hands-on experience in dealing with rapid turnarounds, developing products and growing businesses by helping managers realise their plans.

Our commitment to re-investing profits ensures continual product leadership, which creates a dynamic and exciting environment for our staff.

Financial Technology Investment Approach

- Complexity – We welcome complex transactions and turnarounds. We are set-up to quickly evaluate proposed transactions.

- Substantial Resources – We can self-fund acquisition up to £150M per transaction. We have access to several private equity providers, if required. They have completed over 200 transactions in the past ten years, with equity investment of over £7B.

- Specialist – Able to undertake deal origination, negotiation, financing, team assembly and execution.

- Deal Management – We respond quickly to proposals and communicate proposed transactions to the Investment Committee early.

Financial Technology Investment Criteria

- Mid-Market – Buy-out/buy-in of companies with an enterprise value of £30M–£350M in a substantial market with growth prospects.

- Strong Management – A must for any transactions. We can help assemble teams if necessary.

- Pan-European – Comfortable overseeing transactions outside the UK.

- Strategy – To organically grow organisation through a buy and build strategy.

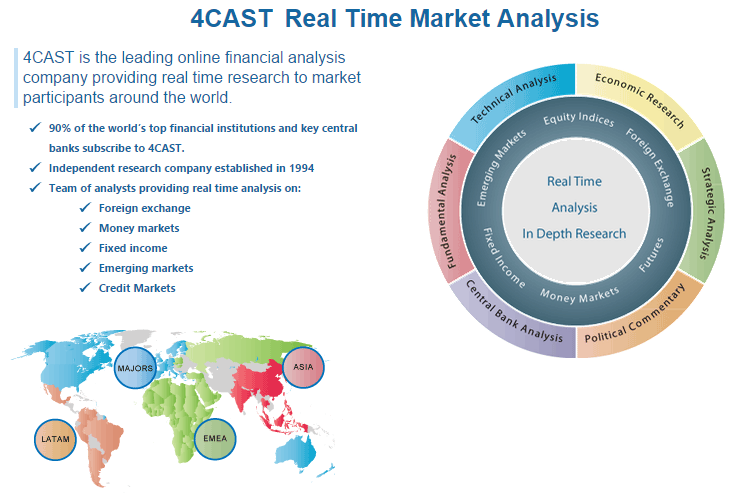

4CAST Holdings Ltd

4CAST has offices in London, New York and Singapore.

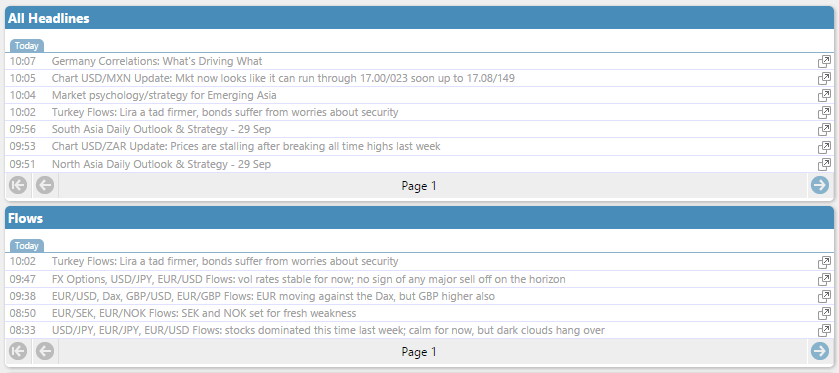

4CAST is unique among its competitors in that it has developed a hosting platform that is easily scalable, customisable at a tag level and can easily absorb content production by other authoring systems or replace them.

The user interface is almost entirely graphics-based making content absorption fast and meaningful. Navigation is also super-fast.

FX Market Alerts

The customer instantly receives FX analysis delivered by email on specific Forex related topics. The service covers technical chart analysis, market flows, central bank insights, economic data and general market commentary.

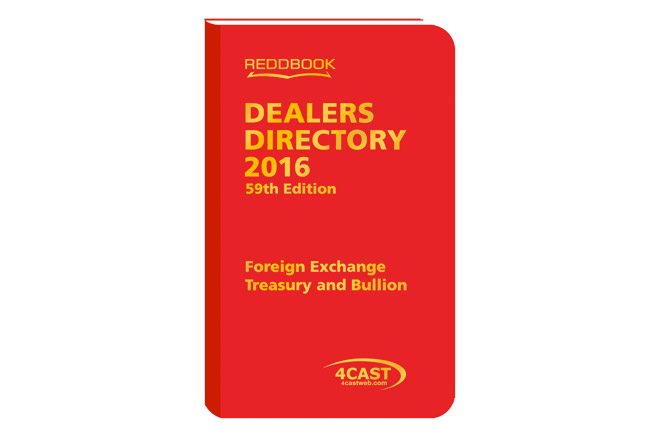

Reddbook

With over 10,000 dealers listed from 1,200 banks in over 65 countries, the directory continues to be an invaluable tool in the constantly evolving foreign exchange market.

Over the coming months The Reddbook is being updated to include chat services integrated to Bloomberg Chat and Reuters Messenger.

With topical forums and free FX content from 4CAST, it is set to become an interesting portal for this specialised community.

Prime Central Let (PCL)

The plan is to help tenants find their long stay home easily, without trekking to a gazillion properties before they find the ideal place.

Compared to large serviced apartment sites and agency sites, PCL allows you to see the exact apartment you will be taking, not the ‘type’ of apartment and so avoiding the disappoint when you arrive.

Compared to estate agency sites, PCL allows you to navigate through a vast number of properties, save them to a shortlist and send that selection to our staff to follow-up.

Also the landlord has to provide images, specifications of common parts and services allowing the tenant to accurately assess without having to attend the property in the first instance.